The world of networking is shifting faster than many of us anticipated. If you’re managing an enterprise network, building out data center capabilities, or even supporting hybrid work models, you’ve likely noticed the increased focus on high-performance routers and switches. It’s no longer just about moving data—it’s about doing it smarter, faster, and more reliably than ever. Between 2023 and 2028, the global market for these essential devices is projected to grow significantly. Back in early 2021, the Ethernet switch segment already hit a notable revenue milestone, reflecting the critical role these technologies play in modern digital infrastructure.

This growth isn’t happening in a vacuum. Changes in work culture, like the widespread shift to remote and hybrid models, are pushing companies to invest heavily in robust networking solutions. Similarly, the rise of streaming, cloud computing, and IoT devices is placing new demands on networks everywhere. Whether you’re evaluating new hardware or planning a network upgrade, understanding these market forces isn’t just helpful—it’s necessary.

Market Overview and Regional Dynamics

North America continues to lead in adoption and innovation. This makes sense—the region’s early embrace of cloud technologies, along with major investments in broadband and corporate infrastructure, has set a high bar. With so many people working from home, reliable and high-speed internet is no longer optional. Enterprises are upgrading their switches and routers to handle increased traffic and ensure security.

Meanwhile, the Asia Pacific region is catching up quickly. Rising smartphone penetration, along with growing demand for on-demand video and digital services, is driving steady investments in network hardware. Countries like China, Japan, and South Korea are accelerating deployment of carrier Ethernet and high-capacity routing systems.

Europe presents a more mixed picture. While Western European markets remain strong, some regions are seeing slower growth due to softer public sector investment and economic uncertainty. Still, the overall trajectory remains positive as businesses continue to digitize operations.

Types of Routers and Switches

Not all devices are created equal. Depending on your use case, you might be evaluating:

- •Multiservice Edge Routers

- •ATM Switches

- •Ethernet Service Edge Routers

- •Internet Exchange Routers

- •Service Provider Core Routers

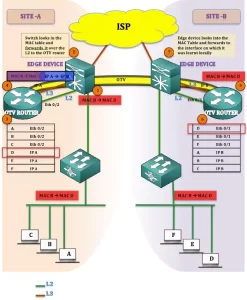

Each serves a distinct purpose. Edge routers, for example, are ideal for connecting large networks to the internet, while core routers are built for high-speed data transit within a network backbone. Understanding these differences helps in selecting the right device for the right layer of your infrastructure.

Key Service Categories

When we talk about services, we’re referring to how these devices are actually used. Common applications include:

- •Ethernet Aggregation

- •Internet Data Center/Collocation/Hosting

- •Ethernet Access

- •BRAS (Broadband Remote Access Server)

Ethernet aggregation is particularly relevant for service providers who need to combine multiple connections into a single high-bandwidth link. Similarly, BRAS is becoming increasingly important for managing subscriber access in large-scale broadband networks.

The Cloud: A Major Growth Driver

One of the biggest factors shaping the router and switch market is the large-scale move to cloud-based solutions. As more organizations migrate workloads to the cloud, their need for high-availability, low-latency networking grows. This isn’t just about internet access—it’s about building seamless connections between offices, data centers, and cloud providers.

Carrier Ethernet and wireless backhaul technologies are also evolving rapidly. These aren’t niche products anymore. They’re central to how modern businesses and telecom operators deliver services.

Remote work is here to stay, and that means even home networks are becoming more sophisticated. The line between residential and commercial equipment is blurring, with more people investing in prosumer or entry-level enterprise gear for better reliability.

Major Players Shaping the Industry

A handful of companies dominate the global market. Cisco remains a top player, especially in enterprise routing and switching. Huawei and ZTE have grown tremendously, particularly in Asia and other price-sensitive markets. Ericsson continues to play a key role in service provider solutions, especially with the rollout of 5G networks worldwide.

Other notable vendors include Actelis Systems and ALE International. These companies may not have the same market share as the giants, but they often serve specific niches—like industrial IoT or secure communications—where customization and reliability matter most.

Innovation in this space is constant. We’re seeing more software-defined features, better integration with security protocols, and hardware that’s designed for scalability. For anyone buying, specifying, or managing network infrastructure, keeping an eye on these vendors’ latest releases is well worth the time.

So where does the router and switch market go from here? The ongoing expansion of high-speed internet, the convergence of home and business networks, and the non-negotiable demand for cloud readiness all point toward sustained growth. It’s not just about buying equipment—it’s about building networks that can adapt.

Whether you’re upgrading a small business setup or designing a multinational data infrastructure, the message is clear: routers and switches are more critical than ever. They’re the backbone of digital communication, and as traffic grows and applications become more complex, having the right hardware in place will separate high-performing networks from the rest.

For further insights, configuration guides, and product comparisons, visit telecomate.com. We help professionals like you make sense of networking technology—so you can build faster, smarter, and more connected systems.

Leave a comment