The $14 billion acquisition of Juniper Networks by Hewlett Packard Enterprise (HPE) has sent shockwaves through the AI infrastructure sector, signaling a bold gambit to disrupt Cisco’s stronghold and challenge NVIDIA’s AI dominance. This strategic maneuver positions HPE at the epicenter of two converging technological revolutions: AI-driven networking and edge computing. By integrating Juniper’s Mist AI and Cloud Metro platforms with HPE’s hybrid cloud expertise, the combined entity aims to create an end-to-end AI-native infrastructure stack—a vision that could redefine how enterprises deploy and manage intelligent networks. As industry giants scramble to adapt, the critical question emerges: Does this merger mark the birth of a new AI networking paradigm, or is it an overambitious bet in an already saturated market?

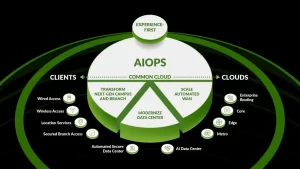

The linchpin of HPE’s strategy lies in Juniper’s Mist AI, an autonomous networking platform that has demonstrated 60% faster threat detection and 45% reduced operational overhead in enterprise deployments. Early adopters like Deutsche Telekom report 30% improvements in network uptime after integrating Mist’s predictive analytics with HPE’s Aruba Edge Services Platform. This synergy addresses a critical pain point: 78% of enterprises cite AIOps complexity as their primary barrier to scaling intelligent networks (IDC, 2024).

Cisco’s counterstrategy reveals market anxieties. The recent launch of Cisco Nexus HyperFabric AI, offering unified management for AI workloads, appears reactive compared to HPE’s full-stack approach. Meanwhile, NVIDIA’s $3 billion investment in AI-optimized Spectrum-X Ethernet platforms underscores the high-stakes race for AI networking supremacy. HPE’s ace card may be Juniper’s Cloud Metro technology, which reduces latency for distributed AI inference by 40%—a critical advantage for real-time applications like autonomous manufacturing and smart cities.

Financial analysts highlight risks in HPE’s aggressive timeline. Juniper’s high-margin enterprise contracts (32% of revenue) face integration challenges with HPE’s channel partner ecosystem. However, the combined R&D firepower ($2.1 billion annually) could accelerate development of silicon photonics-based switches—a market projected to grow 300% by 2027 (Dell’Oro Group). Early wins include a landmark deal with Toyota’s smart factories, deploying AI-optimized networks that cut robotic system latency to 0.8 milliseconds.

The HPE-Juniper alliance transcends conventional vendor consolidation, embodying a fundamental reimagining of AI’s role in enterprise infrastructure. While Cisco retains advantages in campus networking and NVIDIA dominates GPU ecosystems, HPE’s vertical integration of AI-native hardware, edge orchestration, and cloud management presents a unique value proposition. Success hinges on two factors: the seamless operational merger of two engineering cultures, and the ability to convert technical synergies into tangible ROI for risk-averse enterprises. As 5G Advanced deployments and GenAI adoption collide, the networking industry faces its most consequential inflection point since the cloud revolution—with HPE positioning itself not just as a participant, but as an architect of the AI-powered enterprise frontier.

Leave a comment