You’ve got projects stacking up, deadlines biting your heels, and a network that’s creaking under pressure. When it comes to infrastructure upgrades, ZTE switch price tags might seem like just another spreadsheet number—but digging deeper reveals whether you’re investing in real value or chasing false economies. Let’s strip away the hype and dissect what actually shapes those figures, so your budget delivers performance, not pitfalls.

The Real Price Drivers: Beyond Sticker Shock

First, brand tier positioning. ZTE plays in a competitive space between premium giants like Cisco and budget no-names. Their switches aren’t the cheapest on the block—and that’s intentional. Paying slightly more versus bargain-bin gear buys you enterprise-grade ASICs, robust VLAN support, and stacking capabilities that won’t crumble under load. Skimp here, and you’ll hemorrhage cash troubleshooting downtime later.

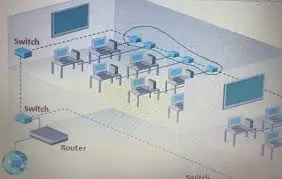

Next, switch class and scale. Comparing a 24-port unmanaged desktop switch to a 48-port fully managed powerhouse is apples-to-wrench. Managed L2/L3 switches pack critical features: PoE++ for power-hungry devices, MACSec encryption for compliance-heavy sectors, and LACP for fail-safe redundancy. Those features directly jack up costs but slash operational headaches. Ask: “Does my use case demand brains or just basic connectivity?”

Port density’s another stealth cost adder. That $299 8-port switch seems tempting—until you’re daisy-chaining five of them across offices, creating SPoF (Single Points of Failure) galore. High-density models (48p+) consolidate hardware, slashing rack space and power draws. Factor in watts-per-port and cooling loads; inefficiency has a compounding price tag.

Software licensing ambushes too. ZTE’s OS—like others—often gates advanced features (think granular QoS or automation scripts) behind subscription tiers. Your “affordable” hardware buy-in might demand $100/year per switch for features you assumed were included. Always dissect the license fine print during pre-sales talks.

Lastly, consider the silent cost of non-ZTE alternatives. Sure, an off-brand switch saves 40% upfront. But will it handle multicast video streams? Integrate with your existing EMS? When a firmware bug nukes your VoIP phones mid-quarter, suddenly ZTE’s premium looks like insurance.

So, what’s the play? Start with ruthless requirements triage. If you’re outfitting a small retail backroom, ZTE’s entry ZXR10 2900 series offers L2 features at digestible prices. For campus backbones with 10G uplinks, the S8900 series justifies its spend with hyper-resilience and zero-touch provisioning—saving weeks of configuration labor.

And let’s talk deployment stagecraft. Buying fully-loaded chassis “just in case”? Terrible economics. Modern ZTE switches support modular uplinks. Start lean with 1G ports; pop in 10G modules only when traffic spikes. Pay-as-you-grow beats overprovisioning every time.

Hardware lifecycle timing matters massively. Launch quarter? Prepare for sticker shock. Gen 2 pricing (12–18 months post-release) often dips 15–20% as configurations standardize. Conversely, last-gen units on closeout slash budgets but gamble on firmware sunset dates—squeeze vendors on support timelines.

evaluating ZTE switch price demands zooming out beyond the invoice. It’s about TCO: energy efficiency slashing OpEx, fewer failures minimizing downtime fines, scalability preventing forklift upgrades. Don’t ask, “What’s this box cost?” Ask, “What’s not having this capability costing us?” When your network fuels everything from sales calls to security cameras, penny wisdom today becomes pound foolishness tomorrow. Invest in predictability—not price tags.

Leave a comment