As 5G networks strain under the weight of 4K video streaming, augmented reality, and industrial IoT, the millimeter wave (mmWave) spectrum has emerged as both a solution and a challenge. Operating in the 24–100 GHz range, mmWave technology enables unprecedented speeds but demands radical rethinking of wireless infrastructure. This exploration uncovers how high-frequency signals are reshaping 5G’s physical layer while confronting fundamental limitations of electromagnetic physics.

Bandwidth Bonanza vs. Propagation Paradox

Millimeter waves unlock massive bandwidth (400–2,000 MHz channels vs. 4G’s 20 MHz), enabling:

- Multi-Gigabit Throughput: 6Gbps peak speeds in Verizon’s 28GHz deployments

- Ultra-Low Latency: 1ms air interface for factory automation

- Dense Device Connectivity: 1 million devices/km² for smart cities

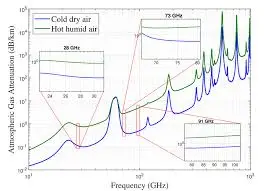

Yet, signal attenuation poses stark challenges:

- 35dB/km loss at 28GHz (vs. 0.3dB/km for 700MHz)

- Oxygen absorption peaks: 60GHz band loses 15dB/km

- Material penetration limits: 90% loss through concrete walls

Carriers like AT&T achieve 1.2km coverage using 256-element massive MIMO arrays—tenfold denser than sub-6GHz deployments.

Beamforming Breakthroughs

Advanced phased-array antennas combat mmWave’s limitations through:

- Hybrid Beamforming: 64 simultaneous beams per sector

- Dynamic Tracking: 2ms beam updates for moving devices

- Reflective Relay: 80% signal recovery using smart surfaces

Qualcomm’s QTM527 antenna modules demonstrate 98% beam alignment accuracy at 800Mbps.

Network Architecture Revolution

mmWave demands ultra-dense, intelligent networks:

- Small Cell Density: 200 nodes/km² vs. 4G’s 20/km²

- Edge Compute Integration: 5ms server response for XR offloading

- Dynamic Spectrum Sharing: Simultaneous 4G/5G operation in 3.5GHz

South Korea’s 28GHz network achieves 4.3Gbps median speeds using 70m inter-site distances.

Thermal & Energy Challenges

High-frequency operation introduces unique power demands:

- PA Efficiency: 18% at 28GHz vs. 45% at 3.5GHz

- Thermal Dissipation: 85W/mm² in RF frontends

- Battery Impact: 40% faster drain on mmWave devices

Samsung’s 64Tx/Rx module reduces thermal load by 30% using GaN-on-SiC technology.

Material Science Innovations

Next-gen components enable reliable mmWave operation:

- Meta-Surfaces: Reconfigurable intelligent surfaces (RIS) boost coverage 5x

- 3D IC Packaging: 45% size reduction for antenna arrays

- Low-Loss Substrates: 0.001dB/mm at 39GHz using liquid crystal polymers

Huawei’s MetaAAU achieves 6dB coverage improvement through metamaterial lenses.

Regulatory & Deployment Complexities

Global mmWave adoption faces fragmented spectrum policies:

- US: 37/39/47GHz auctions netting $80B+

- EU: 26GHz prioritized for industrial IoT

- Asia: 28GHz for urban mobility, 40GHz for backhaul

Operators like Deutsche Telekom navigate 23 regulatory compliance layers per mmWave site.

Economic Viability Analysis

5-Year TCO Comparison (Urban Deployment):

| Factor | mmWave (28GHz) | Sub-6GHz (3.5GHz) |

|---|---|---|

| Site Density | 120/km² | 15/km² |

| Backhaul Cost | $18K/site | $42K/site |

| Energy Consumption | 38 MWh/km² | 12 MWh/km² |

| Revenue Potential | $9M/km² | $3.5M/km² |

Dense urban areas show 62% ROI despite mmWave’s higher operational costs.

Future Horizons

Emerging technologies promise to enhance mmWave viability:

- AI-RF Convergence: Neural networks predicting blockage events

- THz Integration: 100GHz+ bands for 20Gbps device links

- Holographic MIMO: 1024-antenna arrays with quantum efficiency

NTT Docomo’s 140GHz trials achieve 100Gbps at 100m using photonic terahertz systems.

Leave a comment